How an AI Copilot Can Lift the Expertise of Agents, Bankers & Branch Staff

What is an AI copilot?

A copilot is a trusted expert that’s always at your side. In aviation, where the term originates, the copilot works as a team with the captain, communicating, coordinating, and supporting each other throughout the flight. In artificial intelligence, the teaming is between human and machine, as the copilot is a conversational interface that aims to supercharge productivity.

By using large language models (LLMs), AI copilots understand and respond to human language, making it easier for users to interact with and navigate digital platforms. Effectively, a copilot is a type of intelligent virtual assistant or agent that supports users in various tasks and decision-making processes.

Common examples of AI copilots include coding assistants such as GitHub Copilot, writing assistants such as Jasper, and enterprise assistants such as Salesforce Einstein Copilot, Atlassian Intelligence, and Microsoft Copilot that put AI inside existing software products.

Is it a virtual assistant, agent, or both?

The terms AI assistant and AI agent are often used interchangeably, but they represent fundamentally different things. Sure, they’re powered by the same underlying technologies, but they cater to different types of requests.

A virtual assistant is primarily designed for informational retrieval, whereas a virtual agent is designed for autonomous task completion. In the world of retail banking that could mean processing transactions such as paying bills, transferring money, or opening a new account.

The purpose of the virtual agent is to streamline workflows, create efficiencies, and reduce human error. A human agent describes what needs to be done while the virtual agent determines how it’s done. It works in the background to complete whatever tasks that are given to it, all in a way that is secure, verifiable, auditable, and explainable.

What is Microsoft’s enterprise AI copilot?

Microsoft Copilot is an AI companion and everyday enterprise assistant that aims to make people generally more efficient and productive. Integrating with Microsoft 365 apps, the Bing search engine and Windows operating system, it assists users with tasks, such as responding to emails, summarizing meetings, and creating documents.

Similar to Clippy, Cortana and the technologies that preceded it, Microsoft Copilot offers suggestions, automates tasks, and serves as an assistant to the user. It incorporates the tools most recently known as Bing Chat to comb your entire universe of data (emails, meetings, chats, documents, and more) to provide help and guidance.

Role-specific assistants, for sales, service, security, and development, also exist. Copilot for Service launched in public preview in December 2023, and was made generally available in February 2024. It is accessible from the agent desktop, or from Microsoft apps, such as Outlook or Teams, integrating with Dynamics 365 as well as other third-party systems.

Ultimately, Microsoft Copilot is an add-on feature that is licensed separately, and designed, priced and packaged to entice you to use more Microsoft. For the vast majority of employee use cases, that go beyond simple productivity enhancements, financial institutions must leverage Microsoft Copilot Studio (or Azure AI Studio) to build a custom copilot experience.

Microsoft Copilot Agents were announced at Build 2024, its annual developer conference. The plan is to enable developers to build them in Copilot Studio in the future, but the capability is not yet available in the market.

What is interface.ai’s Sphere for Frontline Staff?

Sphere, by interface.ai, is a specialized AI assistant and agent designed for digital banking experiences in the financial services industry. Deployed as a standalone application or integrated tightly with your customer management tools, Sphere assists agents, bankers, tellers, and branch employees to better serve their members or customers.

First, Sphere is designed to empower. It provides frontline staff with quick access to the best possible answers. It creates generative responses, including text, audio, and video, that are grounded in your own trusted content. And it retrieves content from your document stores and knowledge management systems (keeping the structure intact) so you can easily navigate to the most relevant policies, procedures, or product information.

Second, Sphere is designed to transact. A library of plugins enhance the functionality and adaptability turning the assistant into an agent, and ensuring an optimized experience without the hassle of switching between different apps. For example, a member or customer services representative can easily move money through tight integration with core banking applications or enable smooth processing of new loan applications through integration with loan origination systems.

Third, Sphere is designed to personalize. It operates in real-time and provides guidance, insights, and upsell opportunities based on the user context. By analyzing the conversation, the in-context maestro offers intelligent recommendations, suggestions, and relevant information, enhancing the journey. This capability allows the AI assistant to serve as a conductor, adeptly maximizing outcomes for both users and financial institutions.

Assistant: understands human language and user intent, and provides accurate answers to frequently asked questions.

Agent: autonomously processes banking transactions on-demand in a way that is secure, verifiable, auditable, and explainable.

Domain-Specific: offers a library of prebuilt intents, with AI that is continuously trained based on 1.5M banking conversations each day.

Channel-Agnostic: every AI response is informed by previous interactions – experiences are consistent, channels are irrelevant.

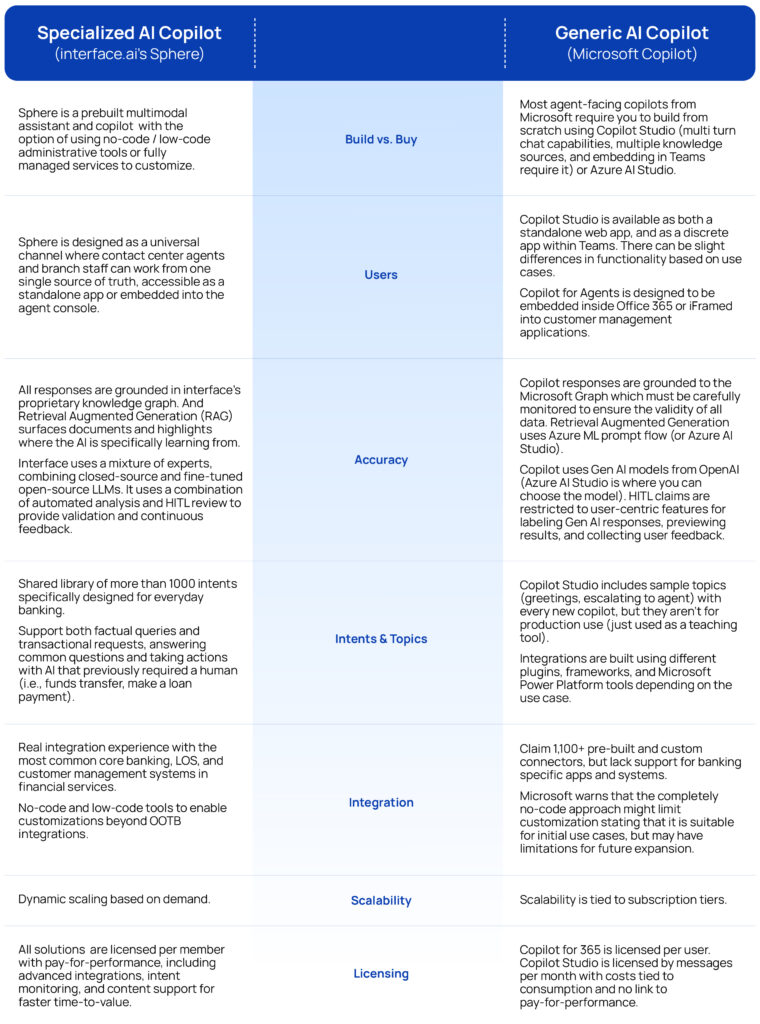

What are the advantages of a specialized AI vs. a generic AI copilot?

A specialized AI has deep domain expertise. It has access to proprietary industry data to effectively train large language models and ground responses for factual accuracy. When you package those models as AI applications, supported by a library of common banking intents, you can deliver tremendous utility, alongside rapid time-to-value.

Generic AI copilots, like Microsoft Copilot, often struggle due to their lack of industry-specific knowledge and context. This can lead to reduced accuracy and efficiency, especially in regulated sectors such as financial services. The experience is as if you’re sharing the same customer service representative across dissimilar industries. Some elements of the conversation will simply be lost in translation.

All AI is only as good as the data which it is trained on. It’s the old adage of garbage in, garbage out. If an AI copilot is modeled on data that is incomplete, biased or wrong in any way, the answers it generates will fall short. When using Microsoft Copilot, an enterprise architecture team will have to carefully monitor the data it can access and is trained on.

For example, since the copilot spans the Microsoft productivity suite, you may not want every document or set of meeting notes included, while some departments may silo data behind firewalls cutting it off from the data stream. Financial institutions will have to decide how to effectively filter data to the benefit (and not the detriment) of AI’s continuous learning.

Data integration also plays a crucial role in the creation of service experiences. Microsoft claims that Copilot for Service can be extended to other systems with more than 1,100 pre-built and custom connectors, but the library lacks any meaningful integration to core banking or customer management systems commonly used by credit unions and community banks, leaving employees endlessly toggling between different apps to get stuff done.

Comparing Copilots: From Specialized to Generic AI

Where can these technologies coexist?

Microsoft Copilot can automate many functions in Office 365. It can help you draft compelling emails, transcribe Teams meetings, and design more effective presentations. This can also extend to service workflows, enhancing email management, classifying and generating case summaries, and supporting more effective routing of issues.

But for most employee or customer-facing use cases, the Copilot capabilities bundled with Microsoft 365 are simply too limited. It requires the full capabilities of Copilot Studio in order to create multi turn chat capabilities that are deeply integrated with the systems and knowledge that your experiences need.

This is where industry-specific AI services working independently or alongside generic AI copilots shine. By deeply understanding language and context, they are ideally suited to automate support queries, streamline knowledge management, and personalize service delivery. Tailored responses, generated with AI, drive higher rates of accuracy and automation, meet regulatory requirements, and boost overall satisfaction rates.

The need for AI copilots to span sales and service.

Successful service engagements are no longer measured solely on whether a customer issue is resolved. As more and more financial institutions seek to shift service operations from reactive response to proactive outreach, it no longer makes sense to think about experiences as discrete channels of delivery.

The lines are blurring between sales and service, and it is becoming increasingly difficult to coordinate consistent omnichannel self-service experiences when multiple AI engines are at play – one copilot for sales, one copilot for service. That is why one specialized AI brain is quickly becoming the preferred choice for financial services organizations, rather than a separate AI for different personas.

Preparing for the future: humans and machines working in harmony.

Generative AI offers the potential to jumpstart productivity and help frontline staff to do more faster. As you consider the different use cases in your organization, deciding where to focus your efforts can feel daunting. You might initially consider use cases that focus on the most frequently asked questions and rely less on deep integration. But to fully reap the benefits of automation, you need to invest in a copilot that can work both alongside humans and for humans as a virtual assistant and agent.

This is a pivotal moment for financial institutions to thoughtfully invest in AI, moving from models that are broad and generic to narrow and specific. By leveraging domain expertise and industry-specific data, credit unions and community banks can realize greater utility, achieve faster time-to-value, and meet regulatory requirements with solutions pre-trained and pre-configured for financial tasks.

AI Insights for Credit Union & Community Bank Leaders

Join the monthly newsletter for all the latest industry updates