Sphere Generative AI Solutions

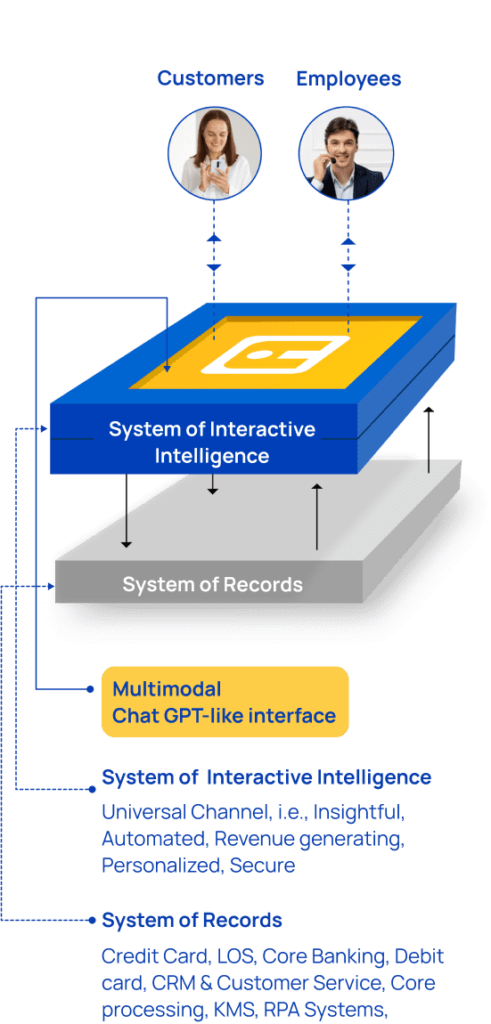

A multimodal, ChatGPT-like assistant for employees and customers.

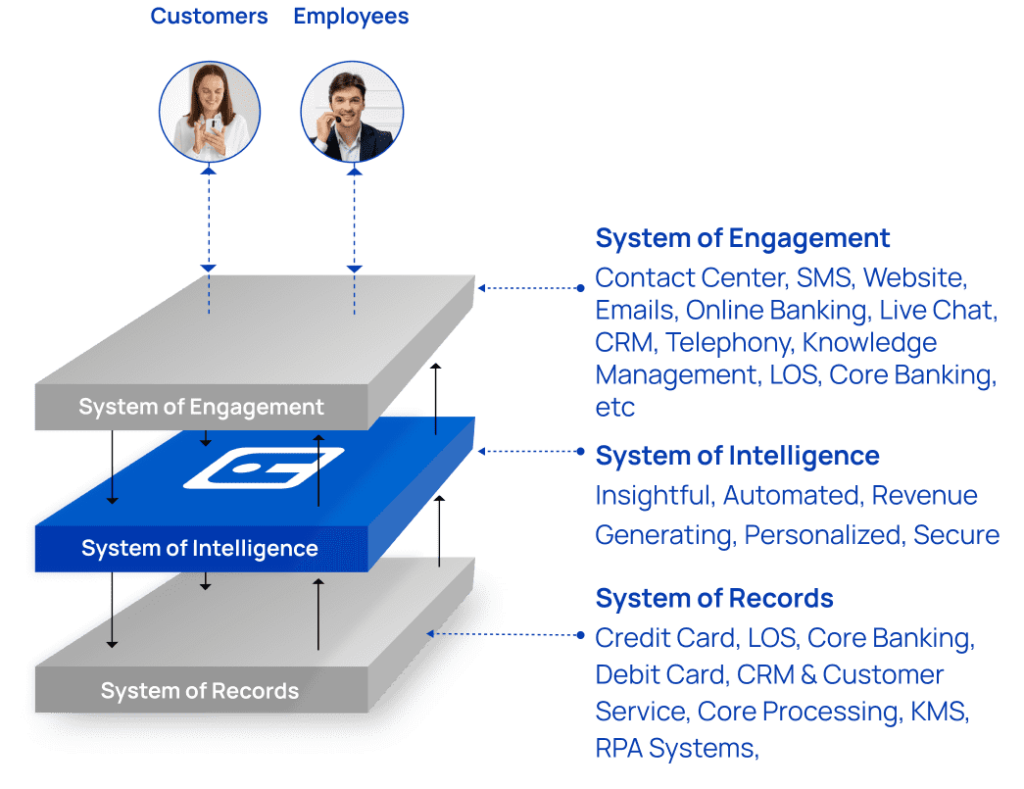

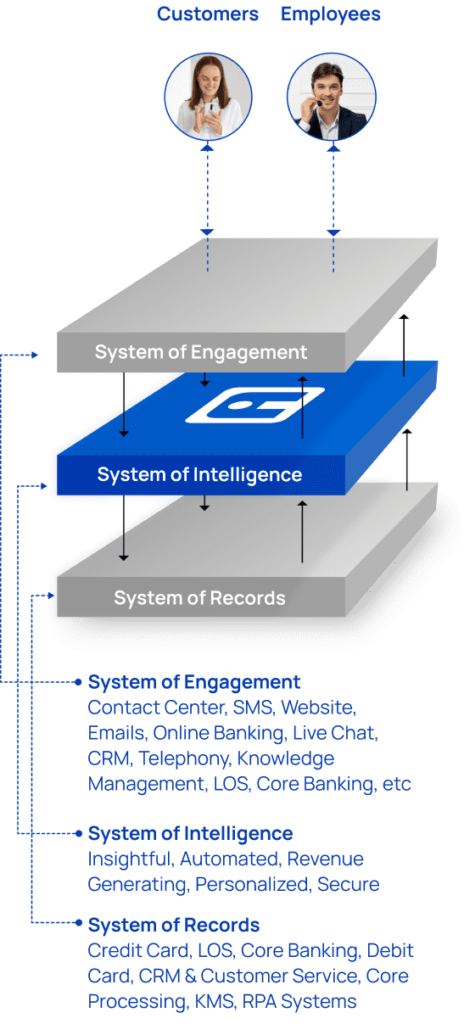

Enterprise-wide AI Solutions for Credit Unions and Banks

Aiding tasks and steadfastly steering customers towards financial wellness

Customers and Employees to seek knowledge and complete tasks 10x faster

Automate nearly 95% of all inquiries handled by customer support

Customer and employees tasks to be either augmented or automated by AI

Discover Sphere for Customers – an industry-first, ChatGPT-like universal channel revolutionizing banking through intelligent guidance, innovative plugins, and personalized AI assistance.

Discover Sphere for Employees – an industry-first, ChatGPT-like universal channel that replaces 14-15 applications traditionally juggled by frontline staff, thereby enhancing frontline operations’ efficiency by 10x.

Universal channel to enhance customer and employee experience

Personalized and proactive guidance to achieve financial wellness

Increased revenue via upsell & cross-sell

Access to real-time information for better decision-making

Improved risk management and better compliance

Greater accuracy and automation through banking domain rich training

“At UCU, interface.ai’s Sphere, a multimodal ChatGPT-like AI Assistant, replaces 14-15 applications, enhancing our frontline operations’ efficiency by 10x.”