Want to Train an AI Chatbot in Minutes, not Months? interface.ai GenAI Instantly Transforms Existing Content into Accurate Interactions

Financial services are under immense pressure to deploy AI, but there are two common , interrelated challenges that they’re facing – the time it takes to train an ai chatbot balanced with optimal user experience.

Community banks and credit unions who haven’t yet implemented AI are falling behind. 53% of financial services companies have already adopted AI-powered chatbots, and this grows by the day. On top of this time-sensitivity, they also need to adopt a bot that is customizable and can deliver an enhanced chatbot user experience.

interface.ai is the only financial services AI provider that achieves both. After years of R&D, interface.ai has developed breakthrough, proprietary technology that allows banks and credit unions to train an AI chatbot in minutes based on existing knowledge resources. With this dynamic knowledge as the foundation, conversations can then also be infused with intelligent workflows that tailor actions and responses for a superior UX. Read on to find out how.

Challenge 1: “It is going to take months to train an AI chatbot, even though we already have all the content that it can be built on.”

Most AI bots today are built manually by writing out each intent (the user’s goals) and the corresponding responses. This static intent-mapping and response generation process is incredibly time-consuming. A standard bot may have up to 500 intents, which would take several months at best to craft. This is particularly resource-wasting when all of this content that the bot is built upon already exists in the form of website pages, videos, and knowledge materials.

And the work doesn’t stop here. The knowledge that the bot is created on must be manually updated whenever information changes to ensure it provides up-to-date and accurate responses. This ongoing maintenance only adds to the resource-heavy burden of bot creation.

Solution 1: Create an interface.ai bot with Generative AI in minutes by indexing your existing content

The development of interface.ai’s GenAI technology has revolutionized the bot creation process. Within day one, your GenAI bot can learn and accurately handle thousands of intents and queries to give you instant coverage. Here’s how.

Instead of training a chatbot manually and time-consumingly on pre-existing content, interface.ai’s GenAI automates the whole process. Users simply upload existing knowledge resources – website URLs, documents, and videos – into the platform’s knowledge repository.

Here, all the relevant information is automatically scraped, processed, and indexed. This structured information is fed into the bot and done – the GenAI bot is ready to answer thousands of customer and member questions within minutes – not months. The bot can directly answer questions directly in the chat window, as well as provide URLs that link to and highlight relevant content (text and video) on the page. The benefits are significant:

- Dramatically accelerates the bot creation process to give you an instant AI foundation that is accurate (because it’s based on your own company content), and helpful (because it’s powered by interface.ai’s highly intelligent graph-grounded and Generative AI technology).

- Generates significant cost savings by automating the data gathering, intent mapping, and response generation processes.

- Reduces maintenance costs as the bot can be easily fed new information as and when required, rather than manually updating each response.

Challenge 2: “I want to configure the bot so it can handle transactional queries and be customized to provide a superior user experience.”

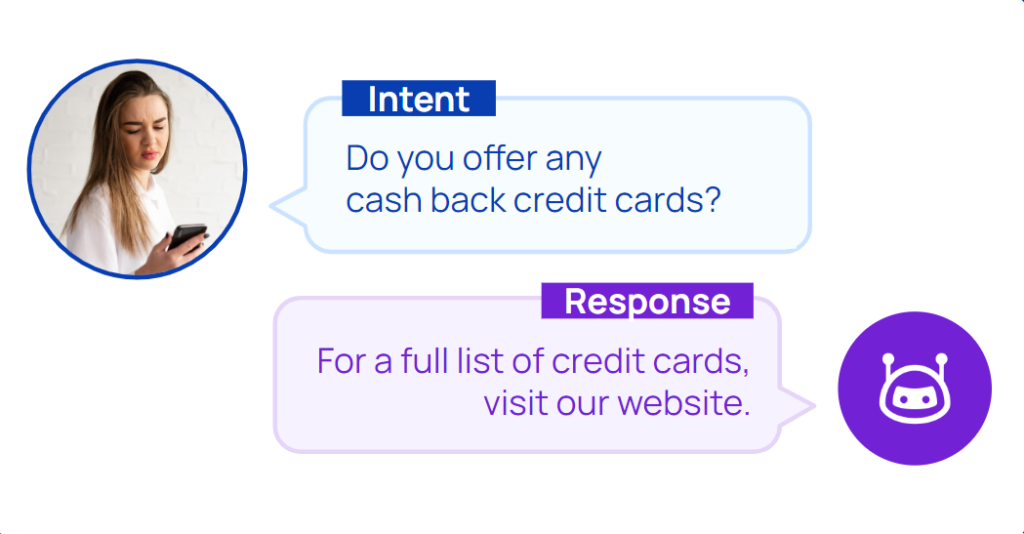

There are hundreds of AI bots on the market that can answer simple informational questions like, ‘what are your branch hours’, or ‘how do I transfer money between accounts’.

However, for AI bots to meet their real potential and truly enhance the chatbot user experience, they must do much more than provide basic responses. They need to manage complex, action-oriented and transactional queries, and align with business processes. Because most Generative AI bots are only trained on broad datasets and lack support for banking-specific workflows, they can’t do this. This ultimately compromises the overall chatbot user experience.

Solution 2: Leverage interface.ai’s intelligent workflows & APIs to manage transactional queries, deliver tailored responses, and enhance UX

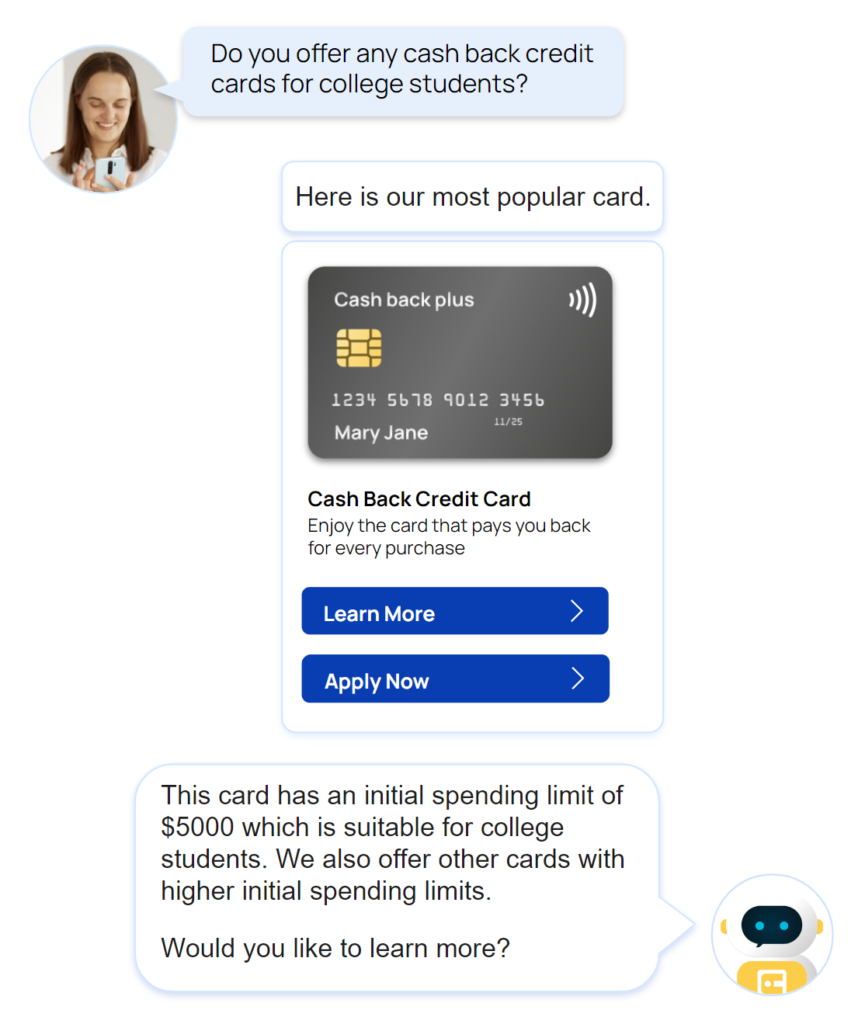

Training a bot can now take minutes, but it should never come at the expense of capability and control. To deliver the most effective chatbot user experience, bots need to handle task-oriented and transactional queries (interactions where the customer seeks to complete a specific action), as well as simple informational questions. interface.ai makes this possible with its breakthrough, proprietary technology powered by intelligent workflows.

Workflows are predefined, structured sequences of actions that guide how a bot interacts with a user. interface.ai has developed pioneering technology that allows these workflows to override the standard Generative AI response when required. While dynamic GenAI responses may manage informational queries, the workflows enable richer, action-orientated conversations. This enables them to provide more helpful and actionable support that is better aligned with your business objectives, such as registering for online banking or scheduling an appointment. It also gives you control over the chatbot user experience during the most important conversations.

interface.ai offers a large variety of pre-built workflows for financial services that can be seamlessly integrated into the bot, instantly enhancing its functionality and chatbot user experience. You can also create your own workflows through the self-service portal or interface.ai’s white-glove managed services. To power this further, interface.ai offers out-of-the-box integrations with key financial services systems so the bot can handle even more complex and transactional requests.

Here is just a sample of what these workflows can achieve for members and customers:

- request financial statements and tax documents,

- select a specific branch for loan callback requests,

- receive an SMS for directions to their nearest ATM and,

- initiate and manage the payoff of their loans.

This unique Generative AI configuration combines two essential knowledge architectures:

- Dynamic knowledge from multiple sources that can be set up on day one to provide instant automation coverage and a contextual understanding of the conversation.

- Mapped knowledge through workflows to provide greater control, capability, and customization with 1) custom responses and, 2) adaptive responses through third-party integrations and APIs.

The generic response without workflows

The specialized response with interface.ai workflows

Wrap-up

Every financial services AI provider struggles with the balance of training a chatbot quickly while delivering superior UX and control – except interface.ai.

Interface.ai is the only AI built for banking that fuses dynamic and mapped knowledge together. Its proprietary technology enables banks and credit unions to fully automate the bot creation process, transforming existing content into a hyper-intelligent bot within minutes. On top of this, interface.ai powers richer, more complex interactions through intelligent workflows and integrations to give you control and your customers superior CX. And all of this is wrapped up in a highly secure system through our proprietary technology that’s built for regulated environments.

interface.ai’s Smart Discovery bot perfectly showcases this breakthrough tech. Learn more about it, or schedule a personalized demo where we’ll demonstrate the bot in action with content we’ve auto-indexed from your site.

AI Insights for Credit Union & Community Bank Leaders

Join the monthly newsletter for all the latest industry updates